1

You may be eligible for Social Security

benets by earning Social Security

credits when you work in a job and pay

Social Security taxes.

We base Social Security credits on the

amount of your earnings. We use your

earnings and work history to determine

your eligibility for retirement or disability

benets or your family’s eligibility for

survivors benets. We cannot pay

benets if you don’t have enough credits.

In 2024, you receive 1 credit for each

$1,730 of earnings, up to the maximum

of 4 credits per year.

Each year the amount of earnings

needed for credits goes up slightly as

average earnings levels increase. The

credits you earn remain on your record

even if you change jobs or have no

earnings for a while.

Special rules for some jobs

Special rules for earning Social Security

coverage apply to certain types of work.

If you are self-employed, you earn

Social Security credits the same way

employees do (1 credit for each $1,730

in net earnings, but no more than 4

credits per year). Special rules apply

if you have net annual earnings of

less than $400. For more information,

read If You Are Self-Employed

(Publication No. 05-10022).

2

If you are in the military, you earn

Social Security credits the same way

civilian employees do. You may also get

additional earnings credits under certain

conditions. For more information, read

Military Service and Social Security

(Publication No. 05-10017).

We also have special rules about how

you earn credits for other kinds of work.

Some of these are:

• Domestic work.

• Farm work.

• Work for a nonprot or religious

organization that does not pay Social

Security taxes.

Contact us if you have a question about

how you earn credits in your job.

How long you must work to be

eligible for Social Security

The number of credits you need to be

eligible for benets depends on your age

and the type of benet.

Retirement benets

Anyone born in 1929 or later needs 10

years of work (40 credits) to be eligible

for retirement benets.

Disability benets

How many credits you need for disability

benets depends on how old you are

when your disability began.

3

• If you develop a disability before age

24, you generally need 1½ years of

work (6 credits) in the 3 years before

your disability began.

• If you are between ages 24 through

30, you generally need credits for ½ of

the time between age 21 and the time

your disability began.

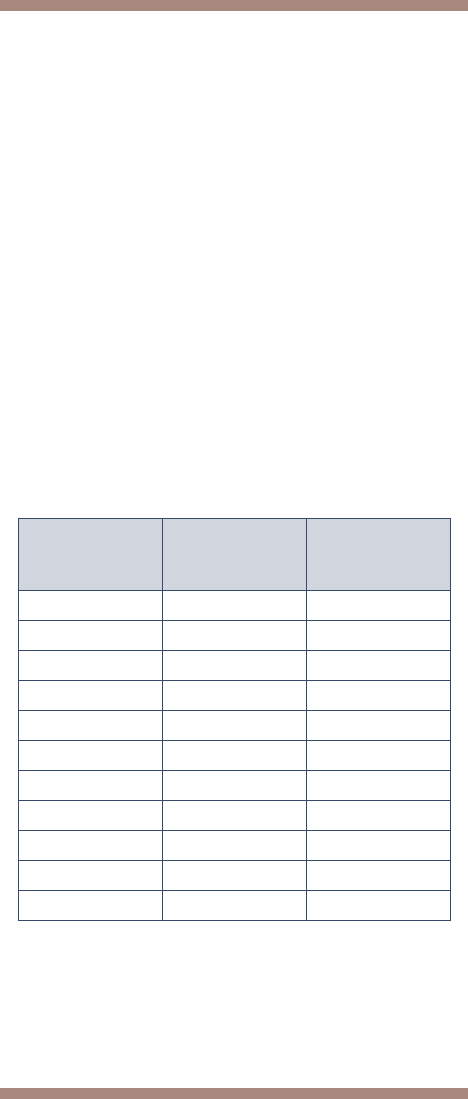

• A person with a qualifying disability

at age 31 or older, generally needs

at least 20 credits in the 10 years

immediately before their disability

began. The following table shows

examples of how many credits you

would need if you develop a disability

at various selected ages. This table

does not cover all situations.

Developed

a disability

at age

Credits

needed

Years of

work

31 through 42 20 5

44 22 5 ½

46 24 6

48 26 6 ½

50 28 7

52 30 7 ½

54 32 8

56 34 8 ½

58 36 9

60 38 9 ½

62 or older 40 10

Survivors benets

When a person who has worked and

paid Social Security taxes dies, certain

members of the family may be eligible for

4

survivors benets. Up to 10 years of work

are required to be eligible for benets,

depending on the person’s age at the time

of death. Survivors of very young workers

may be eligible if the deceased worker

was employed for 1½ years during the 3

years before their death.

Social Security survivors benets can be

paid to:

• A surviving spouse — full benets

at full retirement age, or reduced

benets as early as age 60.

• A surviving spouse with a disability —

as early as age 50.

• A surviving spouse of any age who

takes care of the deceased’s child.

This child must be younger than age

16 or have a disability, and receive

Social Security benets.

• Surviving divorced spouses under

certain conditions.

• Unmarried children younger than

age 18, or up to age 19 if they attend

elementary or secondary school full

time. Under certain circumstances,

benets can be paid to stepchildren,

grandchildren, or adopted children.

• Unmarried children age 18 or older

who developed a disability before age

22 and whose condition(s) remains

the same.

• Dependent parents age 62 or older.

Contact us if you need more information

about your family’s situation.

5

(over)

Medicare

The Social Security credits you earn

also count toward eligibility for Medicare

when you reach age 65. You may be

eligible for Medicare at an earlier age if

you get disability benets for 24 months

or more. Those who have permanent

kidney failure or get disability benets

because of amyotrophic lateral sclerosis

(Lou Gehrig’s disease) do not have to

wait 24 months to receive Medicare

coverage. Your dependents or survivors

may also be eligible for Medicare at age

65 or earlier if they have a qualifying

disability. People who have permanent

kidney failure and need kidney dialysis

or a kidney transplant may be eligible

for Medicare at any age. This is based

on a spouse’s or parent’s earnings

as well as their own. If you would like

more information about Medicare, read

Medicare (Publication No. 05-10043).

Not every kind of work counts

toward Social Security benets

Not all employees work in jobs covered

by us. Examples of some of these

employees are:

• Most federal employees hired before

1984. Since January 1, 1983, all

federal employees have paid the

Medicare hospital insurance part

of the Social Security tax. Railroad

employees with more than 10 years

of service.

6

• Employees of some state and local

governments that chose not to

participate in Social Security.

• Children younger than age 21 who do

household chores for a parent (except

a child age 18 or older who works in

the parent’s business).

Make sure your records

are accurate

Each year, your employer sends a copy

of your W-2 (Wage and Tax Statement)

to us. We compare your name and

Social Security number (SSN) on the

W-2 with our records. Your earnings

shown on the W-2 are recorded on

your permanent earnings record. Your

earnings record is what we use to gure

whether you can get future benets and

the benet amount.

Your name and SSN on your Social

Security card must agree with the

information on your employer’s payroll

records and W-2. Protect your future

benets by making sure both records are

correct. Tell your employer if your name

or SSN is incorrect on the employer’s

record. If your Social Security card is

not correct, contact any Social Security

ofce.

Contacting Us

The most convenient way to do business

with us is to visit www.ssa.gov to

get information and use our online

services. There are several things you

7

can do online: apply for benets; start

or complete your request for an original

or replacement Social Security card;

get useful information; nd publications;

and get answers to frequently asked

questions.

When you open a personal

my Social Security account, you have

more capabilities. You can review

your Social Security Statement, verify

your earnings, and get estimates of

future benets. You can also print

a benet verication letter, change

your direct deposit information (Social

Security beneciaries only), and get a

replacement SSA-1099/1042S. Access

to your personal my Social Security

account may be limited for users outside

the United States.

If you don’t have access to the internet,

we offer many automated services by

telephone, 24 hours a day, 7 days a

week, so you may not need to speak

with a representative.

If you need to speak with someone, call

us toll-free at 1-800-772-1213 or at our

TTY number, 1-800-325-0778, if you’re

deaf or hard of hearing. A member of

our staff can answer your call from 8

a.m. to 7 p.m., Monday through Friday.

We provide free interpreter services

upon request. For quicker access to a

representative, try calling early in the

day (between 8 a.m. and 10 a.m. local

time) or later in the day. We are less

busy later in the week (Wednesday to

Friday) and later in the month.

8

Notes

Social Security Administration

Publication No. 05-10072

January 2024 (Recycle prior editions)

How You Earn Credits

Produced and published at U.S. taxpayer expense